How to Choose the Right Accountant for Your Startup

Find the best accountant for your business. This startup guide helps you choose expert accounting and bookkeeping services with ease.

Finding the right accountant is among the most important choices for your business’s financial health.Ceptrum we specialize in bookkeeping and accounting services for startup that go above and beyond numbers to provide the most strategic financial advice.

Find out how to choose an accountant who can be an integral part of your development.

1. Identify Your Specific Needs

Before you begin searching decide on the level of support you’ll need:

- Essential Compliance (tax filings Annual reports) Development Support (financial modelling, investment preparation)

- Full Accounting Management (CFO services and cash flow optimization)

Ceptrum Insight: Ceptrum startup accounting services have tied packages that correspond to each stage of growth.

2. Must-Have Qualifications

| Credential | Importance |

| CPA License | Essential for complex tax situations |

| Startup Experience | Understands burn rates, funding cycles |

| Tech Savvy | Proficient in Xero accounting software/QuickBooks for small business |

| Industry Knowledge | Familiar with your sector’s financial nuances |

Ceptrum Advantage: All our accountants are CPA-certified with 5+ years in accounting for startups.

3. Key Evaluation Criteria

A. Technical Competence

- Ask about their approach to:

- Accrual vs. cash accounting

- R&D tax credits

- Cap table management

B. Technology Stack

✔ Cloud accounting platforms (Xero/QuickBooks)

✔ Automation tools (receipt scanning, bank feeds)

✔ Security protocols (data encryption, 2FA)

Our Setup: Clients get full access to our Xero accounting software ecosystem with custom integrations.

C. Communication Style

- Look for:

- Proactive updates (not just year-end calls)

- Ability to explain complex concepts simply

- Responsiveness (24-48 hour SLA)

4. Red Flags to Avoid

- Only available during tax season

- Uses outdated desktop software

- No startup clients in portfolio

- Unwilling to sign NDA for sensitive data

5. Special Considerations for Startups

✔ Fundraising Prep: Can they create investor-ready financials?

✔ Equity Management: Experience with ESOPs and 409A valuations?

✔ Global Expansion: Handle multi-country payroll/taxes?

Ceptrum Specialization: We’ve helped 150+ startups secure funding with pitch-perfect financials.

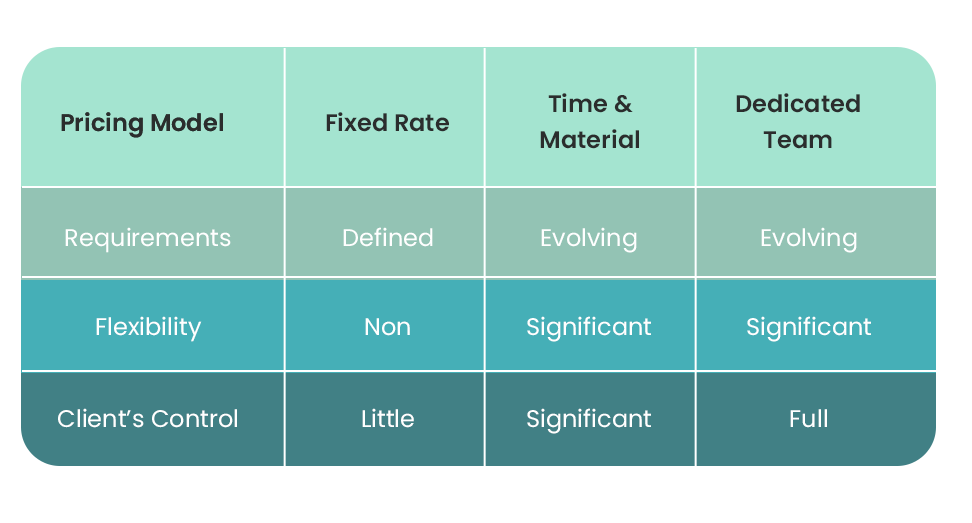

6. Pricing Models Compared

Our Approach: Transparent monthly plans for small company bookkeeping with scalable options.

7. Where to Find Candidates

- Referrals (other founders in your network)

- Platforms (Upwork, CPA directory)

- Specialized Firms (Like Ceptrum for startup-focused support)

8. Interview Questions to Ask

- “How do you stay updated on startup tax incentives?

- “Can you walk me through a client’s fundraising prep process?”

- “What’s your disaster recovery plan for client data?”

- “How do you handle overdue receivables situations?”

Ceptrum Ready: Our accountants complete rigorous training on these exact scenarios.

9. Making the Final Decision

Create a scorecard evaluating:

- Technical expertise (30%)

- Startup relevance (25%)

- Tech capabilities (20%)

- Communication (15%)

- Cost (10%)

10. Onboarding for Success

✔ Grant secure access to your QuickBooks for small business

✔ Set quarterly financial review meetings

✔ Establish KPIs for the relationship

Ceptrum Process: We conduct a free financial health assessment during onboarding.

Why Ceptrum Stands Out

Our Accounting and bookkeeping services for startups deliver:

✅ Dedicated Startup Experts – CPAs who speak your language

✅ Tech-Forward Approach – Seamless Xero accounting software integration

✅ Growth Partnership – From incorporation to Series C and beyond

✅ Transparent Pricing – No surprise fees

Conclusion

Need expert financial support built for growth?

Partner with Ceptrum—your trusted source for accounting and bookkeeping service for startups. From tax strategy to real-time reporting, we help startups scale with clarity and confidence. Visit Ceptrum today and take control of your financial future.